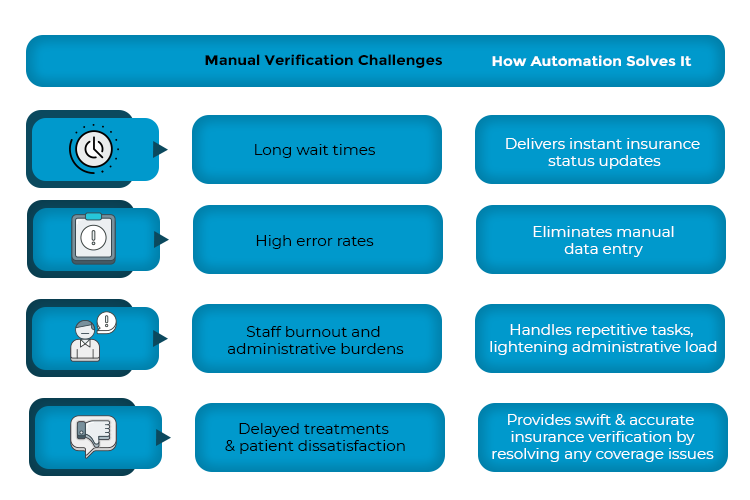

Ever feel like insurance verification is like a game of roulette? One wrong spin and suddenly, you’re dealing with denied claims, frustrated patients, and hours lost chasing paperwork. Hospitals and healthcare facilities have used manual verification processes for too long and the result? – delayed patient care and increased stress for staff.

Did you know that the global insurance eligibility verification market is projected to reach $11.4 billion by 2027 from $7.8 billion in 2022? This market is gradually expanding and automation is one of its key drivers for growth. Imagine having the facility of real-time coverage checks and error-free verifications without any pre-visit headaches. That is how automation changes the game.

Ready to know how automation can turn eligibility verification into a smooth, reliable process that makes life easier for everyone – even for your front desk team? Let’s dive in!

Key Areas Where Automation Transforms Insurance Eligibility Verification

Real-time Data Retrieval

Manual verification often involves calling insurers, navigating complex portals, and longer wait times for responses. Not only does it waste time, but it also increases the risk of coverage errors. However, automated systems can solve this issue by retrieving insurance details in real-time within seconds by pulling updated coverage information from the databases of multiple insurers. With automation, staffs spend less time chasing information and will have instant access to details such as patient coverage status, co-pays, deductibles, etc.

Batch Processing

Processing insurance details manually is a time-consuming process, especially for facilities that handle a large number of patients. Automation helps streamline batch processing, allowing providers to conduct insurance verification simultaneously for multiple patients. The way it works is that the system processes several records at once , flagging any issues before patient visits. Thus, clinics stay ahead of their schedules and clear eligibility in advance, removing any administrative bottlenecks.

EHR Integration

Implementing Electronic Health Records (EHS) leads to 86% faster access to patient information. However, manual entry of eligibility data into the systems can lead to several errors. Automation, on the other hand, seamlessly integrates with EHRs, ensuring instant and accurate synchronization of insurance details. Once the eligibility for a patient is verified, their profile is automatically updated within the systems, making it easier for healthcare providers to check and retrieve patient information whenever needed.

Pre-service Verification

Waiting for insurance verification at the time a patient arrives can disrupt clinical workflows and cause frustrating delays. But with pre-service verification, automated systems can speed up the process before the patient arrives for treatment. They run eligibility checks 24 to 48 hours in advance and send notifications if pre-authorization is required or in case of any coverage issues. Thanks to this, patients are informed of any issues ahead of time, which also provides a window for healthcare providers to resolve them before they arrive.

How Automating Insurance Eligibility Verification Streamlines Claims Processing

Automated insurance eligibility verification works through the integration of advanced softwares and tools with the healthcare facility’s EHR, after which claims processing is done in the following order:

Step 1: Data Integration

Once an automation system is integrated with the EHR, it is connected to various insurance databases, enabling practitioners to have real-time access to insurance information. And when patients schedule a medical appointment, their basic information and insurance details are entered into the EHR.

Step 2: Real-time Verification

The automated system retrieves the insurance information of patients from the insurer’s databases and conducts a comprehensive verification of their coverage status, going through key details such as active insurance policies, effective dates, and checking if there is any missing or inaccurate information.

Step 3: Coverage Analysis

The insurance coverages are analyzed to determine co-payments, deductibles or any other exclusions that may apply for certain medical services.

Step 4: Alerts and Notifications

When the system identifies any discrepancies during the verification process, it sends an immediate alert or notification to staff members so they can promptly resolve the issue and ensure that there are no further errors.

How Automation Benefits Insurance Eligibility Verification

By enabling automated insurance eligibility verification, healthcare facilities can mitigate the challenges of manual verification and unlock a plethora of benefits such as:

- Maximum operational efficiency: By automating insurance verification, healthcare providers can verify insurance coverages in a fraction of time. It can analyze large amounts of data quickly, allowing staff members to divert their time and resources to more important administrative tasks.

- Reduced errors: Manual data entry or verification can lead to billing inaccuracies and claim rejections in case of any errors. Automation, on the other hand, enhances the accuracy of patient data and minimizes errors, thus improving billing and revenue cycle management.

- Significant cost savings: Manual insurance verification requires significant labor costs and any errors committed can lead to higher costs incurred. Reworking and resubmitting an insurance claim usually costs between $25 to about $180, which is an unnecessary expense healthcare practitioners have to bear. Automation, in this scenario, reduces staffing requirements, improves resource allocation, and helps avoid any resubmission or similar expenses that result from errors.

- Improved patient experience: Verification delays can lead to dissatisfaction among patients as they might have to wait for prolonged hours for treatments. Automation helps expedite insurance verification with higher speed and accuracy, reducing their burdens and ensuring they receive quality and timely treatment.

The primary goal of automating insurance eligibility verification is to reduce the administrative burdens of manual verification and the errors that may arise out of it. For a more practical understanding of how automation streamlines verification processes, this case study highlights how eClaimStatus transformed eligibility verification for a Texas-based Free-standing ER Client.

Staying Ahead of the Curve with eClaimStatus

Gone are the days of frantic calls to insurance providers and endless data entry. From smooth EHR integrations and bulk processing to faster verifications, automation can give your healthcare practice a significant boost, reducing administrative burdens and allowing you to focus on delivering exceptional patient care. And if you’re looking for the best platform that can offer you these facilities, look no further than eClaimStatus.

Our platform implements uniquely defined algorithms that optimizes the verification process to help you save time and increase revenue by keeping the process free of errors and cost-effective. If you’d like to know more about eClaimStatus’ insurance eligibility verification capabilities, sign up today for a 15-day free trial!

Leave your insurance eligibility verification to eClaimStatus. Get started with your 15-day free trial, call us at 310-294-9242 or write to us sales@eclaimstatus.com