When we talk about Oncology and Cancer Treatments, the first thing that comes to mind is the urgency needed in care and the red tape involved in getting Prior Authorization (PA). According to a survey-based cross-sectional study done by JAMA Network, nearly 93% of the oncologists who responded say delays due to such reasons are common. What’s worse? Even a one-day delay in cancer treatments, leads to an increase in the risk of patient death by 3.2%!

With oncology billing already being a complex process owing to multiple specialties in the department, Insurance Eligibility Verification and Prior Authorization processes for cancer treatments can eat into hospital revenue as well as reduce the quality of patient care. But healthcare providers can make this process more timely and effective by adopting different strategies. Let us delve into this article to know more about them.

Challenges in Oncology Insurance

Complex Coding

Different specialties involved in Oncology i.e.Chemotherapy, Immunizations, Surgical Oncology, Radiation Oncology, Medical Oncology, Diagnostic Labs, Hematology, Palliative Care, etc. Each radiation Oncology and medical Oncology, have its own medical code. The complex coding system with various cancer issues requiring different treatment modalities can lead to increased administrative workload, billing inaccuracies, and insurance denials/ delays.

Insurance Denials are Common

Availing insurance for Oncology treatments requires extensive medical documentation and adherence to guidelines. This has led to a high rate of Insurance denials when it comes to cancer treatments. A controlled study further proved this by finding that 20% of their Trial-Eligible patients faced Insurance Denials for Stereotactic body radiation therapy (SBRT).

Struggle with Workflow

Traditional methods in getting insurance coverage i.e. follow-up, talking to agents from multiple providers, checking and rechecking denials and working on its documentation create a significant struggle among the staff and place a lot of strain on the workflow. This affects other areas of work as well, and results in a lack of efficiency.

Tough to Comply with Regulations

With complex coding, common insurance denials/ delays, and inefficiencies in workflow, compliance with regulations is another major challenge. This can lead to disputes, legal consequences, and reputation loss for healthcare providers.

Oncology Coverage Limitations

Cancer treatments or medications are extensive and vary a great deal, depending upon the specialization and the current research and developments specific to that division. Contrastingly, Insurance policies often have coverage limitations for each treatment and lead to confusion in determining the extent of patient and provider responsibility. In such cases, real-time Benefit Verification would be highly helpful.

Prior Authorization is Complex

PA is a common occurrence in cancer treatments, and requires investing significant time and effort, adding another layer of complexity to this process.

Consequences in Oncology Treatment

Inefficient Insurance Eligibility Verification, especially in Oncology, has severe consequences. Early intervention, getting patients on board the latest clinical trials, access to new therapies, treatment options, and medicines, all are very critical in treating cancer. When patients do not have enough or complete access to these owing to insurance-related concerns, it directly impacts their lives, and even if successful in treating the disease, reduces their overall quality of life.

Financial distress due to unexpected or huge out-of-pocket expenses because of delays and denials in insurance adds to the burden of dealing with a life-threatening illness and can even negatively affect the effectiveness of the treatment and recovery.

How to Streamline Your Insurance Verification Process for Better Patient Outcomes?

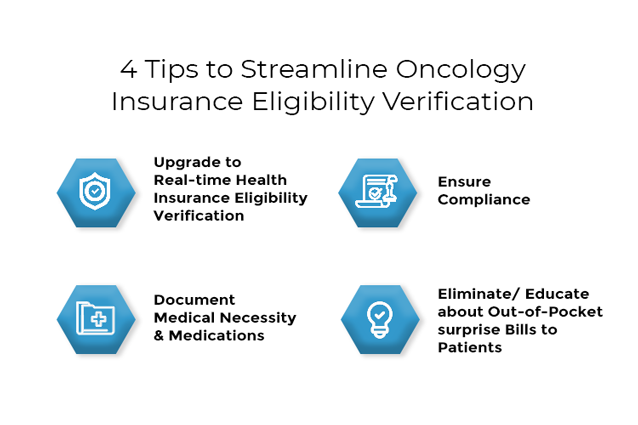

1. Upgrade to Real-time Health Insurance Eligibility Verification

A huge chunk of the challenges in Oncology treatments starts from extensive administrative workload, and the process eating up your staff’s time and productivity. To address these issues, automating the process with Health Insurance Eligibility Verification Software can reduce the burden and improve efficiency. It helps by quickly and accurately verifying insurance eligibility, coverage, and benefits in real-time for the different specialties involved in cancer treatments.

Automation further streamlines the process by reducing the time spent by your staff on manual tasks, minimizes long hold time over the phone with insurance representatives, manual keying errors, and ensures timely claim submissions, follow-ups, and reduces denial rates. Additionally, the staff can raise Prior Authorization requests well in advance, keep track of them, and ensure timely approvals to cut down on delays caused by PA seamlessly with the help of automation.

2. Document Medical Necessity & Medications

Oncology involves different types of drugs, medications, lab tests, and treatments, all coming together to treat a single patient. This necessitates accurate documentation of the treatment methodologies, why they were chosen, and a detailed registry of medications deployed and its effectiveness. This gives you the advantage of presenting necessary clinical notes and documentations to Insurance during claim processing.

3. Ensure Compliance

While ensuring compliance with government regulations, especially since healthcare providers deal with sensitive patient information, is of utmost importance, this comes with the complexity of staying up-to-date with requirements and often needs guidance on how to proceed or understand certain guidelines. A Health Insurance Eligibility Verification Software can also help you with this as the system comes with real-time updates, thereby reducing your risk of facing penalties or fines.

4. Eliminate/ Educate about Out-of-Pocket surprise Bills to Patients

Real-time Insurance Discovery and Insurance Eligibility Verification help you to keep track of the patient’s responsibilities upfront and find insurance that can help them manage their financial distress. This enables healthcare providers to educate them about their financial responsibilities well in advance, thereby managing their expectations and eliminating unexpected costs or bills which can lead to financial stress for the patients.

Deploying Health Insurance Eligibility Verification Software – The Effect on Oncology Treatments

With the help of automation, practices can see better treatment outcomes and patient satisfaction, ultimately leading to good revenue management and success as healthcare providers. In Oncology, the challenges are various and the risks are severe, but with the right tools at your disposal, it is possible to streamline your process while enhancing the overall experience for patients on their treatment journey.

Want to learn more about how this can be made possible? Check out what eClaimStatus can offer you!

Leave your insurance eligibility verification to eClaimStatus. Get started with your 15-day free trial, call us at 310-294-9242 or write to us sales@eclaimstatus.com